The 2023 Shared National Credit Program Report

The 2023 Shared National Credit Program Report showed over $570 billion in troubled assets among U.S. banks participating in leveraged lending.

Key Takeaways:

- Published in February 2024, the 2023 Report covers $6.4 trillion in commitments in over 11,000 facilities.

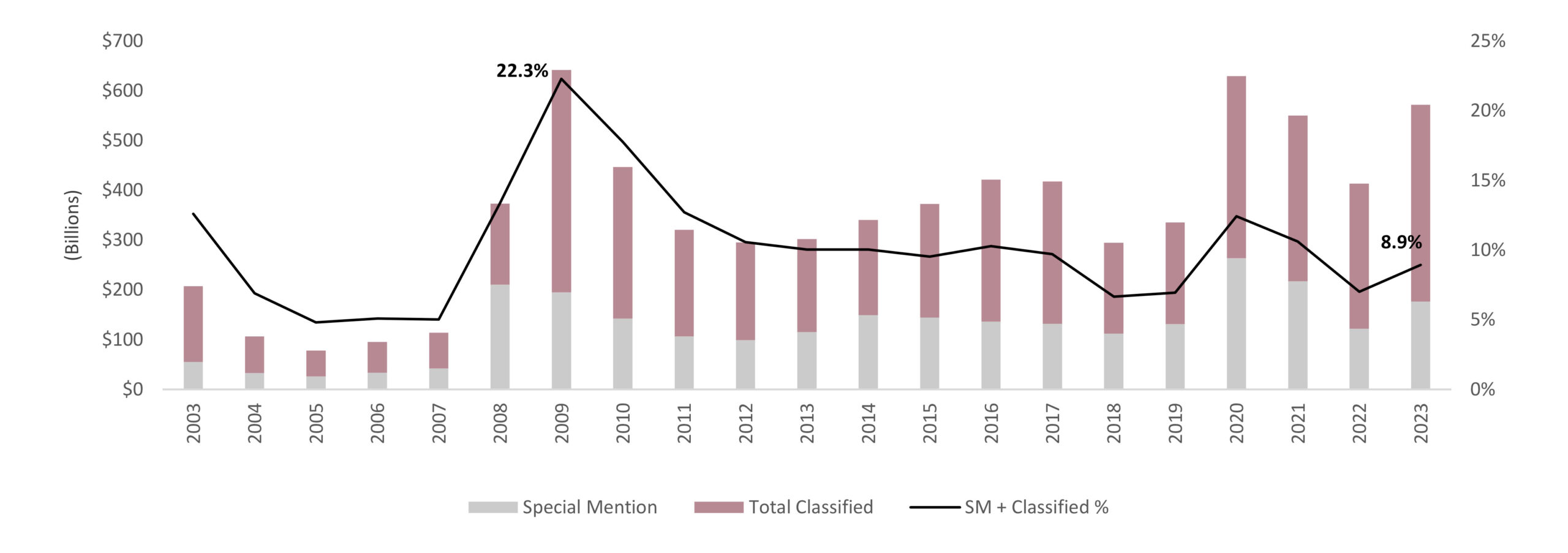

- Troubled loans, designated as “special mention” and “classified”, rose over 38% year-over-year to $572 billion.

- Credit risk in leveraged loans remains high and are a “disproportionately high” portion of the non-pass loans, while special mention and classified loans in the real estate sector “remain[s] below the portfolio average”.

- Marblegate expects U.S. banks to dispose of a large share of the troubled assets that are held on balance sheet creating substantial investment opportunities for turnaround investors who can bring to bear financial and operational restructuring experience.

Troubled Assets Grow in Bank Loan Portfolios

The latest regulatory assessment of U.S. syndicated loans held by three or more banks reveals over half a trillion in troubled assets. This includes $395 billion in impaired loans such as loans in default or likely to default – the highest notional amount since the inception of the program. While the overall level of troubled assets is approximately 9% of all commitments, the report states that this is “muted” by the growth in bank credit. Loan commitments grew by over $500 billion from 2022 to 2023 and by just under $1.4 trillion since the pandemic in 2020. Importantly, real estate debt only makes a small contribution to the overall volume of special mention and classified loans1 despite the heightened concern around the sector by many market participants. Separately, the report states that non-bank lenders hold a “disproportionate share” of special mention and classified loans. Notably, the amount of impaired loans is roughly equal to the $346 billion in unrealized value in all U.S. direct lending strategies excluding mezzanine funds2.

Shared National Credit Program: Special Mention & Classified Loans 2003-20233

About the Shared National Credit Program

The Shared National Credit Program is an interagency program of the Federal Reserve, OCC and FDIC designed to consistently and efficiently analyze the risks in large, syndicated loans shared by banks and non-bank investors, and to classify the loans and other debts of $100mm or more held by three or more lenders that are supervised by these regulatory agencies. The goal of the program is to ensure best practices among institutions and to anticipate issues that could be detrimental to the broader financial system.4 Loans are given three broad classifications – pass, special mention and classified. It is the special mention and classified that are “non-pass loans” and are effectively, troubled assets. Special mention are loans with potential weaknesses that may result in deteriorated repayment prospects. Classified loans are deemed, “substandard”, “doubtful” or “loss” and are loans for which the lender is expected to or has experienced some impairment.5

The “non-pass” classification often requires the bank to set capital aside against these loans or informs the bank that the capital already allocated to these is at significant risk. Higher capital charges and the resources to address the prospect of losses are generally understood to impact a bank’s earnings power and therefore compels banks to sell or otherwise dispose of these loans.

Disclaimer

This paper is for informational purposes only and does not constitute or form a part of an offer to sell or a solicitation to purchase interests in any Fund managed or sponsored by Marblegate Asset Management, LLC (Marblegate) and may not be relied upon in connection with any offer or sale of a Fund. This paper is not a recommendation to buy nor is Marblegate providing any investment advice or recommendation herein. No offer or solicitation may be made prior to the delivery of a definitive confidential private placement offering memorandum (or similar document) (the “Memorandum”). In the event of any conflict between information contained herein and information contained in the Memorandum, the information in the Memorandum will control and supersede the information contained herein. This paper should not form the basis of any investment decision. Investors should conduct their own diligence with the assistance of professional financial, legal and tax experts on the topics discussed in this document and make independent judgements about the relevant markets before making any investment decisions. The information in this paper is only current as of the dates specified and Marblegate assumes no duty to update or correct any information for any reason including new information or subsequent events. The information in this paper should not be construed as a commitment, promise, or guarantee by Marblegate or any other individual or organization affiliated with Marblegate regarding the future availability of opportunities in the U.S. middle market. Marblegate makes no representation or warranty as to the expressed or implied fairness, correctness, accuracy, reasonableness or completeness of any information or opinions in this paper. Certain statements herein reflect Marblegate’s subjective views and opinions, and they should not be construed as material fact.

Footnotes:

- Exhibits 7 & Appendix B, Shared National Credit Report 2023, Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve, and the Federal Deposit Insurance Corporation.

- Prequin: Unrealized value in Direct Lending as of last available data, June 2023.

- Exhibit 3, Shared National Credit Report 2023, Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve, and the Federal Deposit Insurance Corporation.

- Kansas City Federal Reserve, Banking Resources, www.kansascityfed.org/banking/banking-resources/shared-national-credit/

- Appendix A, Shared National Credit Report 2023, Office of the Comptroller of the Currency, Board of Governors of the Federal Reserve, and the Federal Deposit Insurance Corporation.